A private limited company is a company that is privately held for small business. The liability of the members of a private limited company is limited to the amount of shares held by them respectively. Shares of a private limited company cannot be trade in public. The article discusses all aspects of a private limited company.

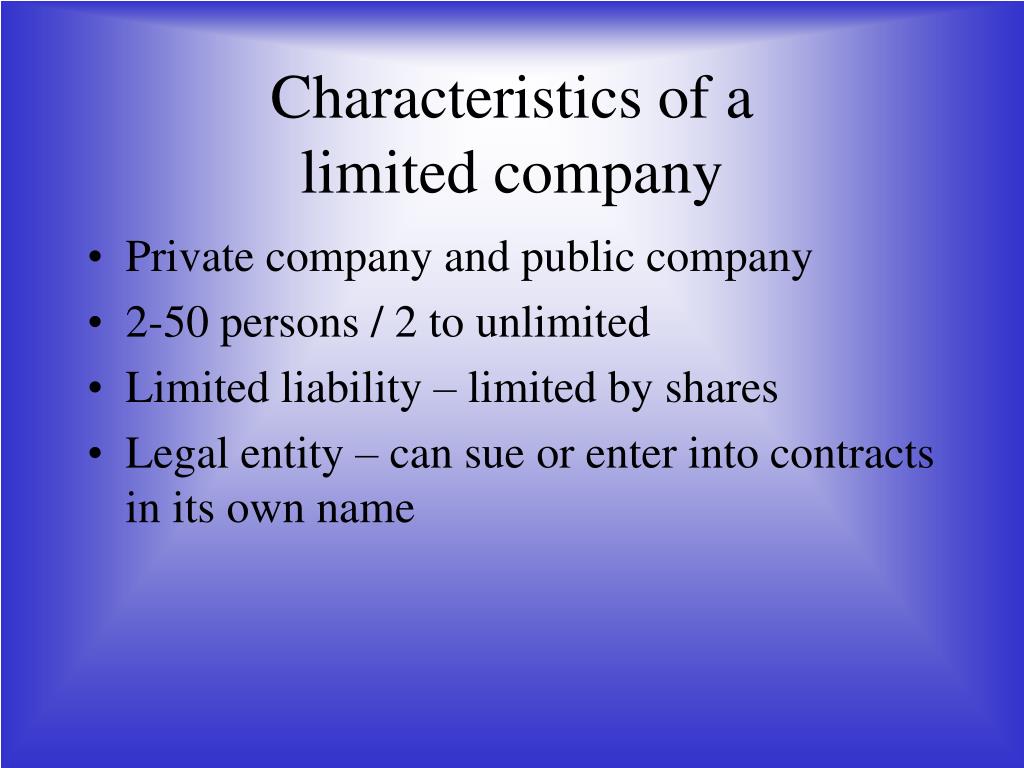

The characteristics of a private limited company

Members

In order to start a company, a minimum of 2 members and a maximum of 200 members are require as per the provisions of the Companies Act, 2013.

Limited Liability-

The liability of each member or shareholders is limited. This means that if a company incurs a loss under any circumstances, its shareholders are liable to sell their own assets for payment. The personal, personal property of shareholders is not at risk.

Permanent succession –

Death, bankruptcy, bankruptcy of any of its members is also in the eyes of the company law. This leads to a lasting legacy of the company. The life of the company lasts forever.

Index of Members –

A private company is privileged over a public company as they are not required to keep an index of its members while a public company is require to maintain an index of its members.

Number of Directors

When it comes to directors, a private company needs to have only two directors. With the existence of 2 directors, a private company can come into operation.

Capital paid

There must be a minimum paid-up capital of Rs 1 lakh or more which may be indicate from time to time.

Prospectus

A prospectus is a detail statement of company matters issued by the company to its public. However, in the case of a private limited company, there is no such need to issue a prospectus as this public company is not invited to subscribe for the company’s shares.

Minimum subscription

It is the amount receive by the company which is 90% of the shares issue during a certain period. If the company cannot receive 90% of the amount, they will not be able to start further business. In the case of a private limited company, shares can be distribute to the public, without receiving a minimum subscription.

Name

It is mandatory for all private companies to use the word private limited after its name.

Documents required

- Capital amount and proposed ratio of shares for share holding

- A brief description of the company and business

- Name of the city where the company registration office is located

- Deed of ownership and sale (if in your own case)

- Proof of identity of the director and shareholders (PAN card)

- Address proof of registered office fee (electricity bill, telephone bill, etc.)

- Address proof of director or shareholder (voter ID, passport, driving license, etc.)

- A copy of the latest electricity bill, telephone bill or mobile bill for the director

- Business details of the director as well as the shareholders.

- Email address of the director and shareholders.

- Contact details of the director and shareholders.

- Passport size photo of the director and shareholders

- If the property is on rent, you need to submit a copy of the lease agreement with a No Objection Certificate (NOC) from the landlord

- Affidavit for unacceptable

- NOC for change in MOA’s original subscribers

- MoA and AOA subscriber sheets

- Company PAN Card

- If you are a foreign national customer you need to provide proof of nationality

Procedure for registration of a private limited company

Once the name for the company has been decide, the applicant will have to take the following steps:

Apply for Digital Signature Certificate and Director Identification Number

Apply for name availability

File MOA and AOA for registration of a private limited company Apply for company page and TN

Certificate of investment will be issue by ROC along with PEN and TAN Open a current bank account in the name of the company

Advantages of private limited companies

Ownership

In a public company, ownership of the rules and shares can be sell to the public in the open market. In a private company, on the other hand, the shares may be sell or transfer to others by the owner’s choice. The shares of such companies belong to the establishment, management or group of private investors. Shares here do not sell on the open market. Thus the number of shareholders will be less. It means less complexity and confusion in decision making and management.

Minimum number of shareholders

For a private company, the minimum number of required shareholders is 2, while for a public company; need at least 7 shareholders.

Legitimate creations

If we are thinking of starting a public company, you better be prepare as there is a long list of legal formalities for creating a public company. There is a shorter list compare to private companies.

Disclosing information

The public company is require to disclose its financial reports every quarter, as it will affect public investment; Private companies do not have to suffer any such compulsion.

Management and decision making

Management and decision making in public companies becomes more complex and confusing as more and more shareholders have to be consulted. This complicate process in a private company has been eliminated because the number of shareholders is small.

Focus on management

Managers of public companies focus on increasing the value of shares, while managers of private companies are more flexible in short-term and long-term business decisions.

Stock market pressure

Private companies are not pressure by the stock market and you don’t have to worry about shareholder expectations and interference as long as they act within the law. Shareholders in public companies focus on current earnings and they put pressure on the company to increase earnings.

Long term planning

Managers of public companies are pressure to increase earnings in the short term in order to increase the value of their shares. Private companies can focus on long-term earnings as such pressures are remove

Minimum share capital

You will need a lot of money for a public company. A public company must pay at least Rs. 5, 00,000. The previous minimum share capital for a private company was Rs. 1, 00,000, but now there is no least enforcement. So there is no pressure for funding requirements.

Confidential

It is clearly not appropriate; let competitors know about your business secrets. Confidential information such as executive compensation, legal settlements and other essential information cannot be reserved in public companies.