A private limited company is a secretly held business substance. It is secretly held by the investors and the greatest investors ought not to be more than 200. The risk course of action in a private limited company is that of a limited association, wherein the obligation of an investor stretches out simply up to the quantity of offers held by them. Past the worth of the offers, the investors can’t be expected to take responsibility. Prior to the enlistment of a private limited company, it’s still up in the air. The administering body for such an company is the Ministry of Corporate Affairs (MCA). In this blog I have discussed about who controls the Private limited company.

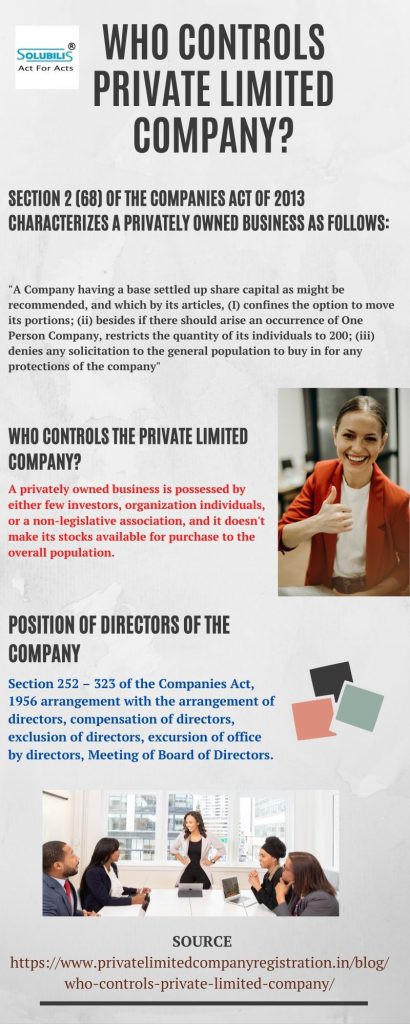

Section 2 (68) of the Companies Act of 2013 characterizes a privately owned business as follows:

“A Company having a base settled up share capital as might be recommended, and which by its articles, (I) confines the option to move its portions; (ii) besides if there should arise an occurrence of One Person Company, restricts the quantity of its individuals to 200; (iii) denies any solicitation to the general population to buy in for any protections of the company”

Characteristics

A private limited company has the accompanying attributes:

Enrollment: In request to begin a private limited company, similar to some other company at least two investors is required. Be that as it may, in light of the fact that it is a private company holding endeavor, there is additionally a greatest cap on the quantity of individuals fixed at 200. There is additionally a prerequisite of two directors to run the company.

Limited Liability Structure: In a private limited company, the responsibility of every part or investors is limited. Hence, even on account of misfortune under any conditions, its investors are responsible to sell their own resources for installment. The individual, individual resources of the investors are not in danger.

Separate Legal Entity: A private limited company is a different legitimate substance and proceeds in never-ending progression. Implying that regardless of whether every one of the individuals kick the bucket, or the company becomes wiped out or bankrupt, the company actually exists according to the law. The existence of the company will be interminable, not impacted by the existences of its investors or individuals except if broke up via goal

Least Paid-up Capital: A private limited company needs to have and keep a base settled up capital of Rs. 1 lakh. It could go higher, as endorsed by the MCA every once in a while.

Least Subscription: Subscription here alludes to the sum got by the company via issuance of offers in a given timeframe. Along these lines, in a given timeframe before the beginning of the business, a company is needed to get 90% of the all-out worth of the relative multitude of offers. Bombing this, without the base membership, the beginning of business isn’t permitted.

So for what reason do public companies go private?

These days public companies are changing over into privately owned businesses in light of the fact that becoming and staying private permits a more significant level of opportunity for company the board to set out on long haul, imaginative, and higher danger adventures without the investigation of stock examiners, financial backers and the media, since the tensions of quarterly outcomes don’t control a privately owned business.

Exclusions of Private Limited Company:

In India, a great deal of new businesses are framed as private limited companies and controls. In the financial plan 2017-18, a few relaxations were declared for new companies. Obviously the public authority has huge assumptions for the startup local section and will make changes to oblige them. The exceptions accessible for a privately owned business are recorded beneath,

Related party trades

Offer capital

Public stores

Meeting necessities

Arrangements and goals

The inspector qualification

Directors

Force of the board

Senior administration arrangement

Here is all you wanted to know about the exclusion of private limited company.

Who controls the Private limited company?

A privately owned business is possessed by either few investors, organization individuals, or a non-legislative association, and it doesn’t make its stocks available for purchase to the overall population.

The Ministry of Corporate Affairs (MCA) is fundamentally worried and controls about the organization of the Companies Act 2013, the Companies Act 1956, The Limited Liability Partnership Act, 2008 and other associated Acts, rules and guidelines outlined and controls mostly for directing the working of the corporate Section as per law.

Position of Directors of the Company

Section 252 – 323 of the Companies Act, 1956 arrangement with the arrangement of directors, compensation of directors, exclusion of directors, excursion of office by directors, Meeting of Board of Directors.

Directorate is the cerebrum and the main mind of the organization which is the body, and the organization can act and controls just through the governing body. A director is an individual who has command over the heading, direct, the executives, or administration of the undertakings of the organization. Just an individual can be selected as a director and can control. An affiliation or a firm can’t be selected as head of an organization.

It isn’t not difficult to clarify the position that a director holds in a corporate venture. A director isn’t a worker of any expert. He is the regulator of the organization’s issues. Head of an organization is neither a representative nor a worker to the organization. They are proficient individuals who were employed by the organization to coordinate its undertakings.

Anyway there is no limitation under the Act, that a director can’t be a worker to the organization. In Lee v. Lee’s Air Farming Ltd2, it was held that, a director may, nonetheless, fill in as a worker in various limit. There is no unequivocal definition for director under the Companies Act, 1956. Director incorporates any individual who is possessing the situation of a director, whatever name called3. So to comprehend the situation of a director in an organization we need to examine to different chose cases.

A Director is a specialist of the Company for the lead of the matter of the organization. Heads of an organization have guardian relationship with the organization just as the investors when he goes about as a specialist or officials of an organization.

The director as the Companies Act, 1956 shows, stands firm and has control on a critical footing in the organization and the executives of a Company. It should be noticed that the director really works in various limits at various occasions to guarantee that the organization is run in a legitimate and an effective way. The Act places colossal obligation on the fighters of the directors.